Sudan Approves 2025 National Budget Amid War and Economic Challenges

Sudanhorizon – Nazek Shammam

Twenty-two days after taking effect, the joint meeting of the Sovereignty Council and the Council of Ministers, chaired by General Abdel Fattah Al-Burhan, Commander-in-Chief of the Armed Forces, approved Sudan’s 2025 national budget on Wednesday. This marks the second budget since the Sudanese Armed Forces entered into conflict with the Rapid Support Forces (RSF).

For the second consecutive year, the budget was passed without detailed figures on projected revenues and expenditures, nor a review of the previous year’s budget performance, as was customary in past years. The approval comes amidst political and economic challenges that continue to weigh heavily on the country.

Key Features of the 2025 Budget

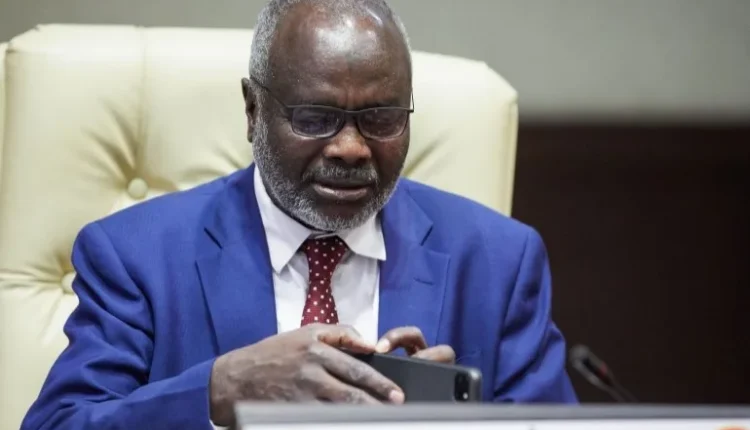

Minister of Finance and Economic Planning Dr. Jibril Ibrahim described the budget as “unconventional” and approved it despite significant national challenges. He announced that the budget includes major spending initiatives, primarily on the war effort, humanitarian aid, health, education, and restoring essential services for citizens. Resources have also been allocated to support refugees and displaced persons while ensuring the provision of critical services.

Dr. Ibrahim expressed hope for increased revenues through the expansion of tax and customs bases. He highlighted that the budget reinstates full salaries for public sector employees, marking a 100% restoration. He emphasized that the budget aligns with citizens’ needs in light of the current national conditions.

The minister also reiterated the government’s commitment to stabilizing macroeconomic indicators, alleviating citizens’ hardships, and controlling inflation and exchange rate fluctuations. He noted ongoing efforts to secure additional resources from regional and international financial institutions, with promises of support from the World Bank and the African Development Bank.

Economic Challenges

Economic journalist Abdelwahab Juma pointed out that revenue generation remains one of the greatest challenges for the budget, especially within a war economy. Increased spending on essential services, such as health and education, is further compounded by the destruction of infrastructure caused by the RSF and years of neglect.

Juma noted obstacles to budget implementation, including cash shortages, limited electronic payment adoption due to weak banking applications and telecom infrastructure, and reliance on taxes and customs—strategies employed since South Sudan’s secession in 2011. He warned that inflation and exchange rate volatility will significantly impact budget performance.

The absence of expatriate remittances, once a key source of foreign currency, and the decline in foreign direct investment due to war conditions, further weaken the budget’s foundations.

Expert Insights

Economic expert Dr. Haitham Mohamed Fathi emphasized that the government must prioritize security, public welfare, and essential services to meet citizens’ needs. He called for enabling domestic investors across sectors by simplifying procedures and supporting productivity.

Dr. Fathi urged the budget to address backlogged salaries, improve public services, and foster private sector participation in financing and employment initiatives. He advocated for integrating graduates into the workforce, empowering youth and women with production resources, and combating poverty and unemployment in stable regions.

Fathi highlighted the war’s crippling effect on production sectors, reducing revenues while increasing military expenditures. Exports have declined, while imports have surged, creating additional economic strain.

The war has also driven significant capital flight, with tens of billions of dollars leaving Sudan. Hyperinflation has resulted in stagflation, characterized by rising prices, declining demand, and economic stagnation—one of the most challenging crises for any economy.

Fathi urged the Ministry of Finance to find long-term solutions to these economic issues while meeting citizens’ basic needs in education, health, clean water, and security. He emphasized the importance of increasing treasury revenues by expanding the tax base and reducing tax evasion to achieve substantial revenue growth.

Despite the lack of confirmed grants and loans, Fathi concluded that reliance on self-resources and improved collection efforts, particularly through enhanced tax policies, could positively impact revenue and reduce budget deficits.

Shortlink: https://sudanhorizon.com/?p=3865